Families First Coronavirus Response Act: What You Need to Know.

PDF Version of This Page

- What is the Families First Coronavirus Response Act?

- Who must comply with the Families First Coronavirus Response Act?

- When is the Families First Coronavirus Response Act effective?

|

- Is my business exempt under the Families First Coronavirus Response Act.?

- What benefits are provided under the Families First Coronavirus Response Act?

- When does the Families First Coronavirus Response Act end?

|

In response to the coronavirus (COVID-19) outbreak, President Donald Trump signed into law the Families First Coronavirus Response Act, a package of provisions providing relief to workers and families. The law, which takes effect no later than April 2, provides paid sick leave, free coronavirus testing, enhanced food assistance and unemployment benefits. It also requires certain employers to create and execute a comprehensive infectious disease exposure control plan.

Emergency Family and Medical Leave Expansion Act

The new law expands the Family and Medical Leave Act (FMLA) to provide a public health emergency leave for employers with fewer than 500 employees. It’s possible that the Department of Labor (DOL) could exempt businesses with fewer than 50 workers, if providing the required leave jeopardizes a business’s viability. Health care providers and emergency responders are also excluded from emergency leave provisions.

Leave is granted to both full and part-time employees, who have been with the organization for at least 30 days (rather than the current-day FMLA requirement of at least 12 months and 1,250 hours worked). The employee must be unable to work (or telework) and be caring for their dependent child because the dependent’s school, place of care or day care facility closed due to COVID-19 to receive the benefit.

As with FMLA, employees taking emergency FMLA leave are entitled to have their position restored to their same or equivalent position. However, employers with fewer than 25 employees are not subject to this requirement if the conditions below are met.

- The employee must take public health emergency leave.

- The employee’s current position no longer exists due to economic conditions or other changes to the operating conditions that impact employment and are caused by a public health emergency that occurs during the leave period.

- The employer makes reasonable efforts to restore the employee to a position equivalent in pay, benefits and conditions of employment to the job held prior to leave.

Emergency Paid Sick Leave Act

Another provision signed into law is the Emergency Paid Sick Leave Act, which will operate alongside the emergency FMLA expansion and also applies to employers with fewer than 500 employees (similar small-business exemptions described above may apply). The law will require covered employers to provide paid sick leave to full and part-time employees regardless of their tenure. Full-time employees receive up to 80 hours of paid sick leave, while part-time employees receive payment based on their average hours worked over a two-week period. Employers cannot force employees to take any accrued PTO, sick or vacation time, but employees can use it if they choose.

If qualified for the leave, an employee must meet one of the four criteria below.

- The employee is currently diagnosed with COVID-19.

- The employee is quarantined or self-quarantined based on the guidance of a health care provider, employer or government official.

- The employee must care for a quarantined or COVID-19 diagnosed individual.

- The employee must care for their dependent child because the dependent’s school, place of care or day care facility closed due to COVID-19.

Both the emergency leave and emergency sick pay provisions are in effect until December 31, 2020.

Tax credits

Covered employers can utilize payroll tax credits to cover 100% of the cost of wages paid under emergency paid leave. An additional credit will be allowed for the amount of the employer’s qualified health plan expenses incurred during the qualified sick leave. The credit will be taken out quarterly against the employer’s Social Security tax payments. Excess credit will be treated as an overpayment that will be refunded.

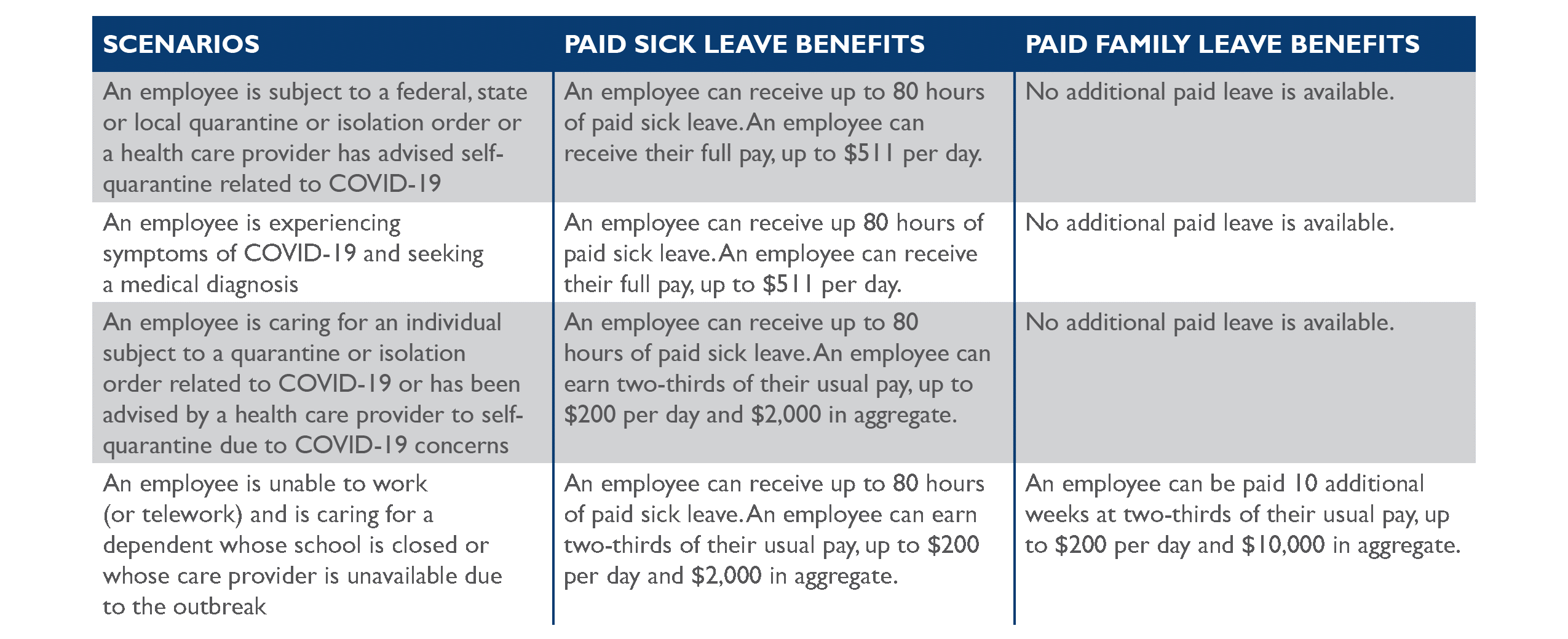

Below is a summary of the applicable sick pay and leave pay scenarios.

We are awaiting Internal Revenue Service (IRS) and DOL guidance for greater clarity. Bukaty Companies will continue to provide updates as more information becomes available.

Have More Questions?

Our HR Consulting and Training Team is available free of charge to answer your Coronavirus related questions. Contact:

Randy Woehl 913-333-3397 rwoehl@bukaty.com

Christina Glapa 913-222-5562 cglapa@bukaty.com

Useful Links for Additional Information on Coronavirus

The counties and cities where we can offer insurance guidance in Kansas & Missouri:

Kansas Counties & Cities

- Douglas County: Baldwin City, Eudora, Lawrence, Lecompton.

- Franklin County: Lane, Ottawa, Pomona, Princeton, Rantoul, Richmond, Wellsville, Williamsburg.

- Jefferson County: McLouth, Meriden, Nortonville, Oskaloosa, Ozawkie, Perry, Valley Falls, Winchester.

- Johnson County: De Soto, Edgerton, Gardner, Leawood, Lenexa, Mission, New Century, Olathe, Overland Park, Prairie Village, Shawnee, Spring Hill, Stilwell.

- Leavenworth County: Basehor, Bonner Springs, De Soto, Easton, Kansas City, Lansing, Leavenworth, Linwood, Tonganoxie.

- Linn County: Blue Mound, La Cygne, Linn Valley, Mound City, Parker, Pleasanton, Prescott.

- Miami County: Fontana, Louisburg, Osawatomie, Paola, Spring Hill.

- Shawnee County: Auburn, Rossville, Silver Lake, Topeka, Willard.

- Wyandotte County: Bonner Springs, Edwardsville, Kansas City Kansas, Lake Quivira.

Missouri Counties & Cities

- Cass County: Archie, Belton, Cleveland, Creighton, Drexel, East Lynne, Freeman, Garden City, Harrisonville, Kansas City, Lake Annette, Lake Winnebago, Lee’s Summit, Peculiar, Pleasant Hill, Raymore, Strasburg.

- Clay County: Avondale, Birmingham, Claycomo, Ectonville, Excelsior Estates, Excelsior Springs, Gladstone, Glenaire, Holt, Kansas City, Kearney, Lawson, Liberty, Missouri City, Mosby, North Kansas City, Oaks, Oakview, Oakwood, Oakwood Park, Pleasant Valley, Prathersville, Randolph, Smithville, Sugar Creek.

- Jackson County: Blue Springs, Buckner, Grain Valley, Grandview, Greenwood, Independence, Kansas City, Lake Lotawana, Lake Tapawingo, Lee’s Summit, Levasy, Lone Jack, Oak Grove, Sugar Creek.

- Platte County: Camden Point, Dearborn, Edgerton, Houston Lake, Kansas City, Lake Waukomis, Northmoor, Parkville, Platte City, Platte Woods, Riverside, Smithville, Tracy, Weatherby Lake, Weston.

|